Background

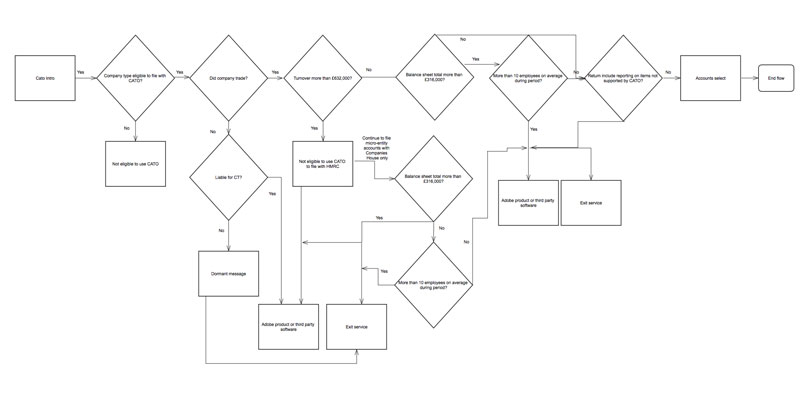

The Company Accounts and Tax Online (CATO) project set out to digitise and simplify Corporation Tax filing for small businesses known as 'micro-entities' who met a defined set of eligibility criteria. These criteria included factors such as turnover and number of employees.

The project was a joint project with Companies House – allowing users to file their accounts and Corporation Tax Return to both HMRC and Companies House in a single filing.

Objectives

Upon arrival at the client site, the project was nearing its assessment to allow the service to enter private beta.

Our main objectives were to:

- · Review all content across the service against the GDS style guide and design principles

- · Iteratively improve service content through user testing

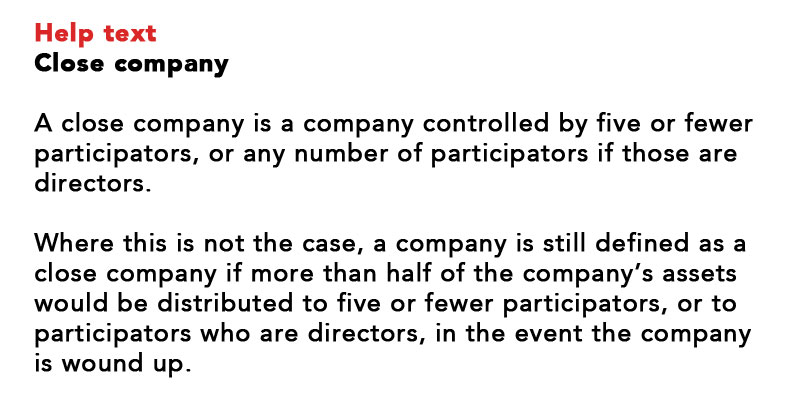

- · Incrementally introduce help text to support fields that identified as difficult with users

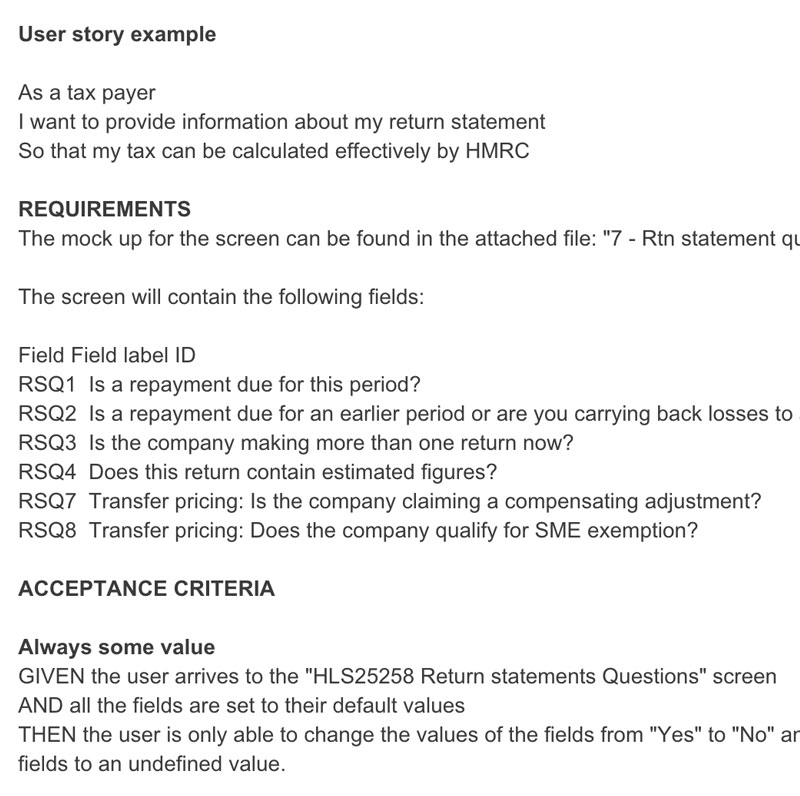

- · Review, edit and test micro-content including field labels, error messages and validation prompts

- · Work with UX designer on content for prototype journeys for forthcoming user journeys

Outcomes

During the contract, we carried out the following work:

- · Worked across 14 fortnightly sprints to incrementally improve service content

- · Helped the product successfully pass its assessment into private beta

- · Introduced new content workflow, allowing content to be pushed to github by content designer

- · Introduced content design into wider team processes – bringing content and UX onto the scrum board

- · Supported business analyst in extra workload in writing user stories

- · Built up relationship between contract designers across London and Newcastle sites